QBE-LawyerGuard – Tip of the Month – Lawyers’ Fraud Avoidance Duties Clarified

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Home » Cyber Insurance

Get a Quote Contact Us Schedule a Meeting Email: info@eno.insure Call: (888) 365-4505

Share

What is Cyber Liability Insurance?

Cyber insurance is a type of insurance policy that provides financial protection to businesses and individuals from losses and damages caused by cyber attacks, data breaches, and other types of cyber threats. These policies typically cover a range of costs associated with cyber incidents, including data recovery, legal fees, public relations expenses, and notification costs.

Cyber insurance policies may also provide coverage for business interruption losses, cyber extortion, and losses due to damage to computer systems or data caused by malicious software or other cyber incidents. Some policies may also offer access to additional resources such as incident response teams, forensic investigators, and cybersecurity experts to help mitigate the effects of a cyber attack.

As cyber threats continue to evolve and become more sophisticated, cyber insurance has become an important tool for organizations and individuals to manage their risk and protect themselves from the potentially devastating financial and reputational consequences of a cyber incident.

What does Cyber Liability Insurance cover?

Cyber insurance covers a range of losses and damages that may result from cyber incidents. The specific coverage provided by a policy may vary depending on the insurer, but typical cyber insurance policies generally cover the following:

It’s important to note that the specific coverage provided by a cyber insurance policy may depend on the insurer, the type of policy, and the policy’s terms and conditions. Therefore, it is important to carefully review the policy’s coverage before purchasing it to ensure that it meets the needs of the organization or individual seeking coverage.

What doesn’t Cyber Liability Insurance cover?

While cyber insurance policies cover a broad range of potential losses and damages resulting from cyber incidents, there are some things that are typically not covered by most policies. Here are some examples of what cyber insurance policies may not cover:

It’s important to review the specific terms and conditions of a cyber insurance policy to understand what is and is not covered. This will help ensure that organizations and individuals have a clear understanding of the risks they are taking on and the types of losses they may be exposed to.

Our Carriers

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years. We take pride in our ability to provide our clients with personalized service and customizable insurance solutions that meet their specific needs. Our knowledgeable and experienced staff is dedicated to providing our clients with the best service possible.

Adam Gwaltney, President, COO

Who needs Cyber Liability Insurance?

Any individual or organization that uses digital technologies to conduct business or store sensitive information should consider purchasing cyber insurance. This includes:

In addition to the above examples, any individual or organization that uses digital technologies to conduct business or store sensitive information should consider purchasing cyber insurance. Cyber threats are constantly evolving, and it is important to be prepared for the financial and reputational consequences of a cyber incident.

What Policy Limits are right for my business?

Determining the appropriate policy limits for a cyber insurance policy will depend on a variety of factors, including the size and type of organization, the amount and type of sensitive information stored or processed, and the potential financial impact of a cyber incident. Some factors to consider when determining policy limits may include:

Ultimately, the appropriate policy limits will depend on the unique circumstances of each organization or individual. It is important to work with a qualified insurance broker or agent to assess your risks and determine the appropriate policy limits for your specific needs.

How much does a Cyber Liability Insurance policy cost?

The cost of a cyber insurance policy can vary widely depending on a variety of factors, including the type and size of the organization, the level of risk associated with the organization’s industry or operations, the amount and type of sensitive information stored or processed, and the specific coverage and policy limits selected. Generally, the cost of a cyber insurance policy will depend on the level of risk the insurer assesses for the organization or individual seeking coverage.

According to a 2020 report by the insurance broker Marsh, the median price for standalone cyber insurance policies was $40,000 for $1 million in coverage. However, policies can cost much less or much more depending on the organization’s specific needs and the insurer’s underwriting criteria.

In addition to the cost of the policy itself, some insurers may also charge additional fees for policy administration, risk assessments, or other services. It is important to carefully review the policy terms and conditions to understand all associated costs.

It’s also worth noting that the cost of a cyber insurance policy may be lower if the organization has implemented strong cybersecurity measures and can demonstrate a commitment to managing cyber risks. Conversely, organizations with poor cybersecurity practices or a history of cyber incidents may face higher premiums or be denied coverage altogether.

To get a better idea of the cost of cyber insurance for a specific business or profession, it’s best to consult with us so that we can provide a customized quote based on the individual needs and risk factors.

Where is the eno.insure team licensed to sell Cyber Liability Insurance?

The eno.insure team is licensed in the following states:

Share

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

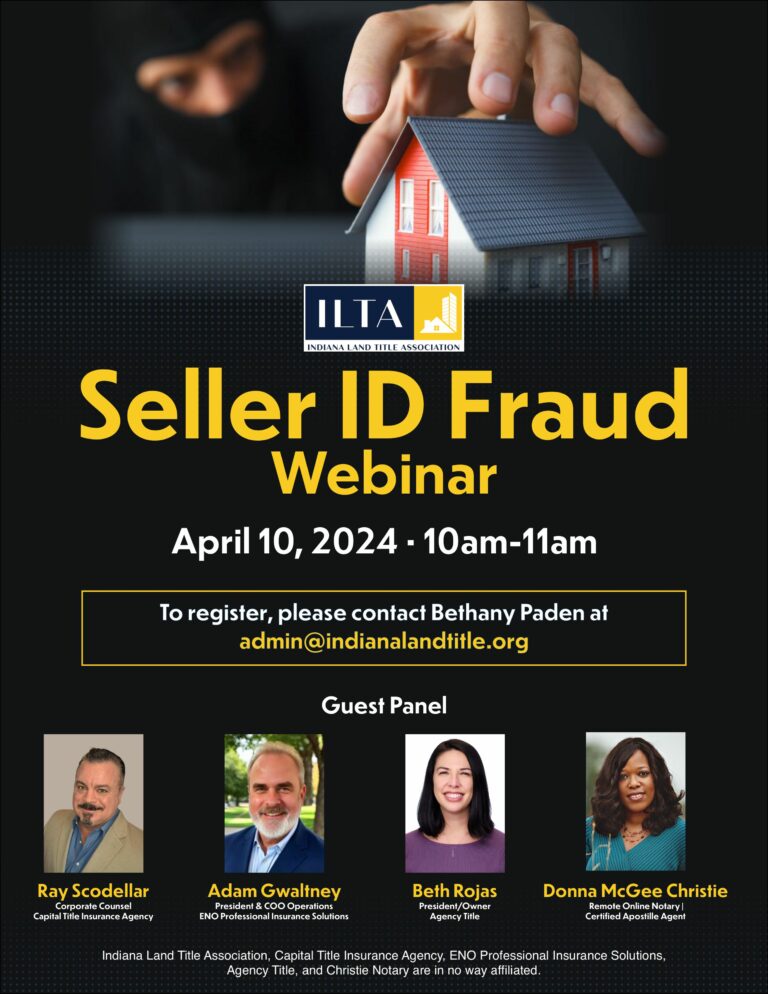

Register for the webinar here.

Despite the emergence of generative AI technologies, the fundamental best practices and security standards for lawyers have remained steadfast. While AI can automate certain tasks

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years.

Sign up for our newsletter to enjoy business tips, inspirations, and invites to free CLE webinars if you are a lawyer.