QBE-LawyerGuard – Tip of the Month – Lawyers’ Fraud Avoidance Duties Clarified

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Please note! At this time, eno.insure is unable to write any business property insurance in the state of Florida. This will include, but may not be limited to, Business Owners Policies, Business Personal Property, General Liability, Commercial Auto, Commercial Umbrella.

Home » Commercial Insurance » Business Owners Insurance

Get a Quote Contact Us Schedule a Meeting Email: info@eno.insure Call: (888) 365-4505

Share

What is Business Owners Insurance?

Business owners insurance, also known as a Business Owners Policy (BOP), is a type of insurance policy designed to provide small business owners with comprehensive coverage for their property and liability risks.

A BOP typically includes two types of coverage:

In addition to these two types of coverage, a BOP may also offer additional options for coverage, such as business interruption insurance, which can help cover lost income if your business is unable to operate due to a covered event, and cyber liability insurance, which can help protect your business against data breaches and other cyber risks.

Business owners insurance is typically designed for small businesses, such as retail shops, restaurants, and small office-based businesses. However, it may not be suitable for larger or more complex businesses that require more customized insurance solutions. It’s important to work with an experienced insurance provider to assess your needs and determine if a BOP is right for your business.

What does Business Owners Insurance cover?

Business owners insurance, or a Business Owners Policy (BOP), typically includes two types of coverage:

In addition to these two types of coverage, a BOP may also offer additional options for coverage, such as:

The specific coverage and policy limits that are included in a BOP will vary depending on the insurance provider and the needs of your business. It’s important to work with an experienced insurance provider to assess your needs and select the right coverage options for your business.

What doesn’t Business Owners Insurance cover?

While Business Owners Insurance (BOP) provides comprehensive coverage for many common risks faced by small businesses, there are some events and types of damage that may not be covered by a BOP. These can include:

It’s important to carefully review the terms and conditions of a BOP to understand what is and isn’t covered, and to work with an experienced insurance provider to identify any additional coverage needs your business may have.

Our Carriers

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years. We take pride in our ability to provide our clients with personalized service and customizable insurance solutions that meet their specific needs. Our knowledgeable and experienced staff is dedicated to providing our clients with the best service possible.

Adam Gwaltney, President, COO

Who needs Business Owners Insurance?

Business Owners Insurance (BOP) is designed to provide comprehensive coverage for small and medium-sized businesses. It may be a good option for businesses that:

However, BOPs may not be suitable for all businesses. Businesses that have unique risks or specialized needs may require additional or alternative coverage. It’s important to work with an experienced insurance provider to assess your business’s needs and identify the right coverage options.

What Policy Limits are right for my business?

The appropriate policy limits for Business Owners Insurance (BOP) depend on several factors, including your business’s size, industry, and risk profile. Here are some key considerations to help determine appropriate policy limits for your business:

It’s important to work with an experienced insurance provider to identify appropriate policy limits for your business. A provider can help you assess your business’s needs and identify the right coverage options to protect your business.

How much does a Business Owners Insurance policy cost?

The cost of a Business Owners Insurance (BOP) policy depends on several factors, including the size and type of business, location, industry, and the coverage limits selected.

The annual premium for a BOP policy typically ranges from a few hundred to a few thousand dollars, depending on the above factors. Small businesses with low risk profiles may pay less, while larger businesses or those with higher risk profiles may pay more.

For example, a small retail store with a BOP policy that provides $1 million in liability coverage and $500,000 in property coverage may pay an annual premium of around $500 to $1,500. On the other hand, a larger manufacturing business with a BOP policy that provides $5 million in liability coverage and $2 million in property coverage may pay an annual premium of several thousand dollars.

To get a better idea of the cost of business owners insurance for a specific business, it’s best to consult with us so that we can provide a customized quote based on the individual needs and risk factors.

Where is the eno.insure team licensed to sell Business Owners Insurance?

The eno.insure team is licensed in the following states:

Share

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

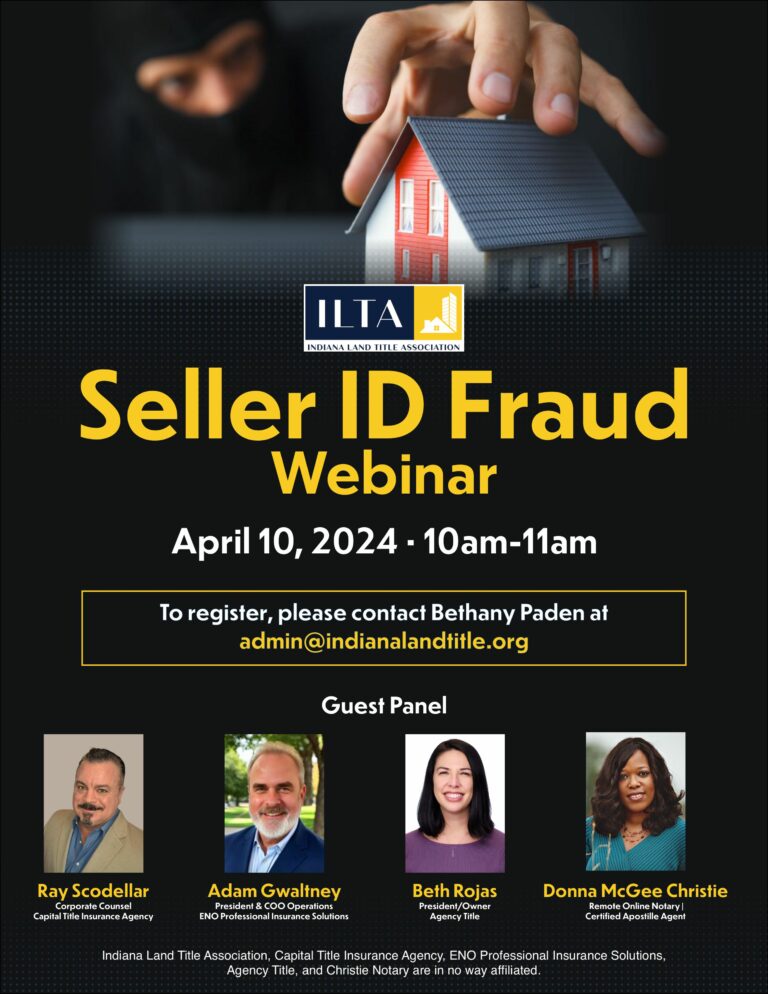

Register for the webinar here.

Despite the emergence of generative AI technologies, the fundamental best practices and security standards for lawyers have remained steadfast. While AI can automate certain tasks

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years.

Sign up for our newsletter to enjoy business tips, inspirations, and invites to free CLE webinars if you are a lawyer.