QBE-LawyerGuard – Tip of the Month – Lawyers’ Fraud Avoidance Duties Clarified

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Home » Professional Liability Insurance

Get a Quote Contact Us Schedule a Meeting Email: info@eno.insure Call: (888) 365-4505

Share

What is Professional Liability Insurance?

Welcome to our page for our Professional Liability Insurance, designed to protect professionals like you from the financial risks associated with providing professional services to clients.

As an professional, you are constantly managing sensitive financial information and providing valuable advice to your clients. Despite your best efforts, mistakes or misunderstandings can occur, and clients may hold you responsible for any resulting financial losses. That’s where our Professional Liability Insurance comes in – it provides the protection you need in the event of a claim against you.

What does Professional Liability Insurance cover?

Professional liability insurance, also known as errors and omissions (E&O) insurance, is designed to protect professionals from claims made by clients or customers alleging that the professional made mistakes or failed to perform their duties properly.

The coverage of professional liability insurance varies depending on the specific policy and industry, but it generally covers:

What doesn’t Professional Liability Insurance cover?

Professional liability insurance, like all insurance policies, has limitations and exclusions. While the specific terms and conditions may vary depending on the policy, here are some common exclusions:

It’s important to review the policy exclusions carefully to understand what is and isn’t covered. If there are gaps in coverage, additional insurance policies may be necessary to fully protect the business and its assets.

Our Carriers

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years. We take pride in our ability to provide our clients with personalized service and customizable insurance solutions that meet their specific needs. Our knowledgeable and experienced staff is dedicated to providing our clients with the best service possible.

Adam Gwaltney, President, COO

Any individual or business that provides professional services to clients or customers should consider getting a professional liability insurance policy. This includes a wide range of professions, such as:

Professional liability insurance can help protect against the costs of defending against claims and any resulting damages or settlements. Without this coverage, professionals and businesses may be liable for significant financial losses that could negatively impact their reputation and financial stability.

In some cases, professional liability insurance may be required by regulatory bodies or contracts. For example, lawyers and healthcare providers are often required to carry professional liability insurance as part of their licensing requirements. Additionally, clients may require proof of insurance before engaging in services.

What Policy Limits are right for my business?

We understand that every firm is different, and so are their needs. Therefore, we offer a variety of policy limits to choose from, so you can customize your coverage to fit your specific requirements. Our experienced underwriter partners can help you determine the right policy limit for your business.

How much does a Professional Liability Insurance policy cost?

The cost of professional liability insurance can vary widely depending on several factors, including the type of business or profession, the level of risk associated with the services provided, and the coverage limits and deductibles chosen. Some other factors that can affect the cost of professional liability insurance include:

Generally, professional liability insurance premiums can range from a few hundred to several thousand dollars per year. Some businesses or professions may also qualify for discounts or lower rates if they have risk management practices in place or if they belong to certain professional associations.

To get a better idea of the cost of professional liability insurance for a specific business or profession, it’s best to consult with us so that we can provide a customized quote based on the individual needs and risk factors.

Where is the eno.insure team licensed to sell Professional Liability Insurance?

The eno.insure team is licensed in the following states:

Share

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

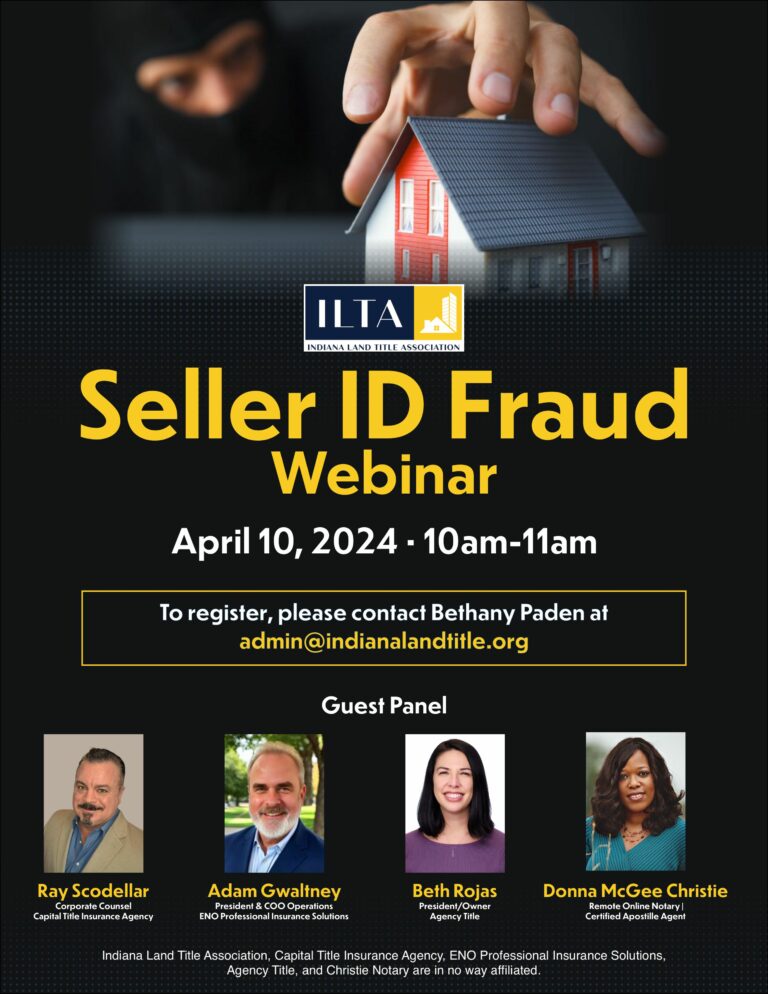

Register for the webinar here.

Despite the emergence of generative AI technologies, the fundamental best practices and security standards for lawyers have remained steadfast. While AI can automate certain tasks

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years.

Sign up for our newsletter to enjoy business tips, inspirations, and invites to free CLE webinars if you are a lawyer.