QBE-LawyerGuard – Tip of the Month – Lawyers’ Fraud Avoidance Duties Clarified

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Home » Professional Liability Insurance » Title Agent Errors & Omissions Insurance

Get a Quote Contact Us Schedule a Meeting Email: info@eno.insure Call: (888) 365-4505

Share

What is Title Agent Errors & Omissions Insurance?

Title Agents Errors & Omissions (E&O) Insurance is a type of insurance that is designed to protect title agents and their businesses from claims and lawsuits arising from errors, omissions, or negligence in the course of providing title insurance services. Title agents are professionals who facilitate real estate transactions by ensuring that the title to a property is clear and free of any liens or other encumbrances that could affect the buyer’s ownership of the property.

Title Agents E&O Insurance provides coverage for a wide range of potential liabilities, including claims related to errors or omissions in title searches, mistakes in the issuance of title insurance policies, and other types of errors or omissions in the provision of title insurance services.

The appropriate policy limits for Title Agents E&O Insurance will depend on a number of factors, including the size and nature of your business, the types of services you provide, and your level of exposure to potential claims and lawsuits. It’s important to work with an experienced insurance agent or broker who can help you assess your risks and determine appropriate policy limits for your business.

The cost of Title Agents E&O Insurance can vary widely depending on a number of factors, including the size and nature of your business, your level of exposure to potential claims and lawsuits, and the level of coverage provided by the policy. However, the cost of insurance should not be the only factor to consider when selecting a policy. It’s also important to consider the level of coverage provided by the policy, as well as any limitations or exclusions that may apply, to ensure that you have the appropriate level of protection for your business.

What does Title Agent Errors & Omissions Insurance cover?

Title Agents Errors & Omissions (E&O) Insurance covers a wide range of potential liabilities that may arise from errors, omissions, or negligence in the course of providing title insurance services. Some of the common types of claims that may be covered by a Title Agents E&O policy include:

The specific coverage provided by a Title Agents E&O policy may vary depending on the insurer and policy terms, so it’s important to carefully review the policy to understand the scope of coverage provided.

What doesn’t Title Agent Errors & Omissions Insurance cover?

Title Agents Errors & Omissions (E&O) Insurance typically does not cover intentional or criminal acts, nor does it cover losses or liabilities arising from certain types of events or circumstances. Some of the common exclusions or limitations in Title Agents E&O policies may include:

It’s important to carefully review the specific exclusions and limitations in a Title Agents E&O policy to understand what types of events or circumstances may not be covered.

Our Carriers

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years. We take pride in our ability to provide our clients with personalized service and customizable insurance solutions that meet their specific needs. Our knowledgeable and experienced staff is dedicated to providing our clients with the best service possible.

Adam Gwaltney, President, COO

Who needs Title Agent Errors & Omissions Insurance?

Title Agents Errors & Omissions (E&O) Insurance is typically needed by professionals in the title insurance industry, including title agents, abstracters, and settlement agents. These professionals provide services related to real estate transactions, such as title searches, title insurance policies, and closing services.

Title Agents E&O Insurance is designed to protect these professionals from claims and lawsuits arising from errors, omissions, or negligence in their professional services. It can provide coverage for defense costs, settlements, and judgments, up to the policy limits.

Many states require title agents to carry E&O insurance as a condition of licensure, and it’s also often a requirement for obtaining contracts with lenders and other clients. Even if it’s not a legal requirement, having Title Agents E&O Insurance can help provide peace of mind and financial protection in case of a lawsuit or claim.

What Policy Limits are right for my business?

The appropriate Title Agents Errors & Omissions (E&O) Insurance policy limit for your business will depend on several factors, including your business’s size, the volume of transactions you handle, your contractual obligations with clients, and the amount of risk you are willing to assume.

Here are some general guidelines to consider:

Typically, Title Agents E&O Insurance policy limits range from $250,000 to $2 million, with $500,000 and $1 million limits being most common. However, depending on your business’s size, risk exposure, and contractual obligations, higher limits may be necessary.

It’s a good idea to consult with an insurance professional who specializes in Title Agents E&O Insurance to help determine the appropriate policy limits for your business.

How much does a Title Agent Errors & Omissions Insurance policy cost?

The cost of a Title Agents Errors & Omissions (E&O) Insurance policy can vary based on several factors, including the policy limit, the size and location of your business, the volume of transactions you handle, your claims history, and your risk management practices.

On average, Title Agents E&O Insurance policies may cost between $1,000 and $5,000 per year for a $500,000 policy limit. However, depending on the factors mentioned above, the cost could be higher or lower.

It’s important to note that the cost of a Title Agents E&O Insurance policy is small compared to the potential cost of a claim or lawsuit. A single claim or lawsuit could easily exceed the cost of the policy, resulting in significant financial losses for your business.

To get an accurate quote for Title Agents E&O Insurance, it’s best to consult with an insurance professional who specializes in this type of coverage. They can help you determine the appropriate policy limit and provide a quote based on your business’s specific needs and risk exposure.

Where is the eno.insure team licensed to sell Title Agent Errors & Omissions Insurance?

The eno.insure team is licensed in the following states:

Share

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

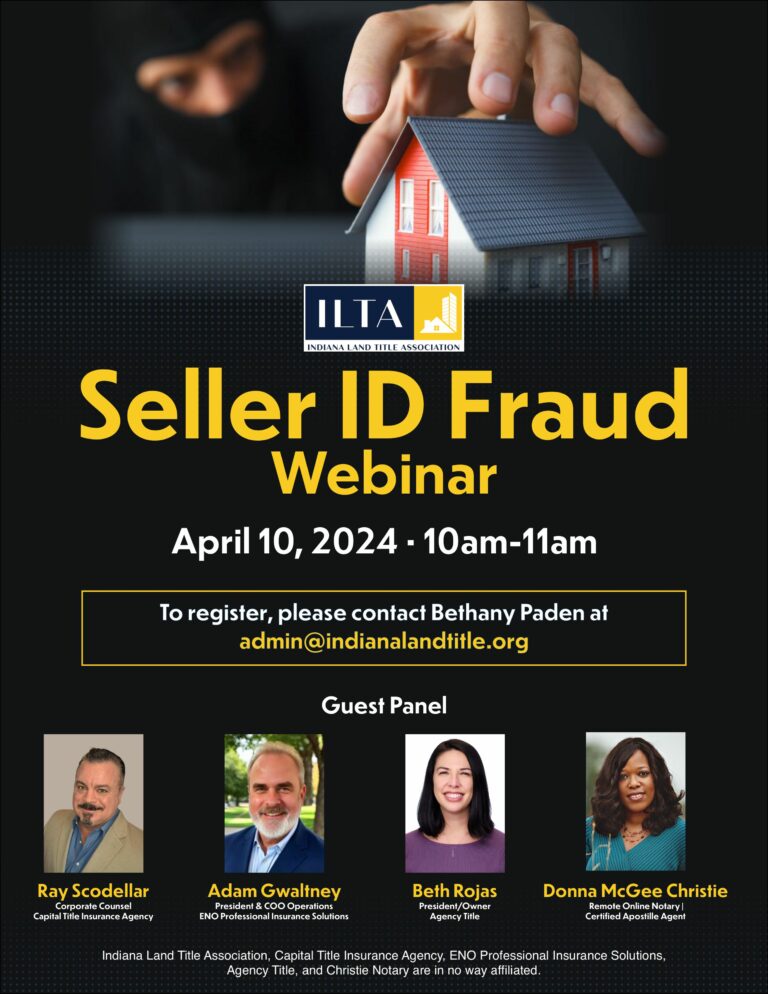

Register for the webinar here.

Despite the emergence of generative AI technologies, the fundamental best practices and security standards for lawyers have remained steadfast. While AI can automate certain tasks

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years.

Sign up for our newsletter to enjoy business tips, inspirations, and invites to free CLE webinars if you are a lawyer.