QBE-LawyerGuard – Tip of the Month – Lawyers’ Fraud Avoidance Duties Clarified

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Please note! At this time, eno.insure is unable to write any business property insurance in the state of Florida. This will include, but may not be limited to, Business Owners Policies, Business Personal Property, General Liability, Commercial Auto, Commercial Umbrella.

Home » Commercial Insurance » General Liability Insurance

Get a Quote Contact Us Schedule a Meeting Email: info@eno.insure Call: (888) 365-4505

Share

What is General Liability Insurance?

General Liability Insurance is a type of business insurance that provides coverage for a range of common risks faced by businesses. This insurance policy protects businesses from financial losses resulting from bodily injury, property damage, and advertising or personal injury claims made by third parties. It typically covers legal fees, medical expenses, and damages awarded to the claimant up to the policy limits. General Liability Insurance can be customized to meet the unique needs of different businesses, and it is often considered essential for businesses of all sizes and types.

What does General Liability Insurance cover?

General Liability Insurance, also known as Commercial General Liability Insurance, provides coverage for claims arising from third-party bodily injury, property damage, or advertising injury that a business may cause in the course of its operations. It covers legal expenses, such as settlements and judgments, as well as the cost of defending a lawsuit. Specifically, General Liability Insurance covers:

Overall, General Liability Insurance provides financial protection against a broad range of potential liabilities that can arise from a business’s day-to-day operations.

What doesn’t General Liability Insurance cover?

General Liability Insurance typically doesn’t cover damages or losses that are intentional, illegal, or beyond the scope of the policy. Here are some examples of what is usually not covered:

Our Carriers

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years. We take pride in our ability to provide our clients with personalized service and customizable insurance solutions that meet their specific needs. Our knowledgeable and experienced staff is dedicated to providing our clients with the best service possible.

Adam Gwaltney, President, COO

Who needs General Liability Insurance?

General Liability Insurance is recommended for all types of businesses regardless of their size, industry or structure. Any business that interacts with the public, has employees, or operates on someone else’s property can benefit from having General Liability Insurance. It is particularly important for businesses that face a higher risk of accidents or lawsuits, such as construction companies, manufacturers, and retailers. Additionally, some industries may be required by law or their clients to carry General Liability Insurance.

What Policy Limits are right for my business?

The appropriate policy limit for General Liability Insurance varies depending on the size and risk level of the business. Small businesses with low risk may only need coverage in the $500,000 to $1 million range, while larger businesses with higher risk may require limits of $2 million or more. Some contracts with customers or clients may also require specific policy limits. It’s important to work with an insurance agent or broker to determine the right policy limits for your specific business needs.

How much does a General Liability Insurance policy cost?

The cost of a General Liability Insurance policy can vary depending on several factors, including the type of business, its size, location, revenue, claims history, and coverage limits. Generally, the more coverage a business needs, the higher the premium. However, the cost of a General Liability Insurance policy can be as low as a few hundred dollars per year for a small business, while larger businesses may pay thousands of dollars annually. It is recommended to get quotes from several insurers to compare coverage and pricing options.

Where is the eno.insure team licensed to sell General Liability Insurance?

The eno.insure team is licensed in the following states:

Share

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

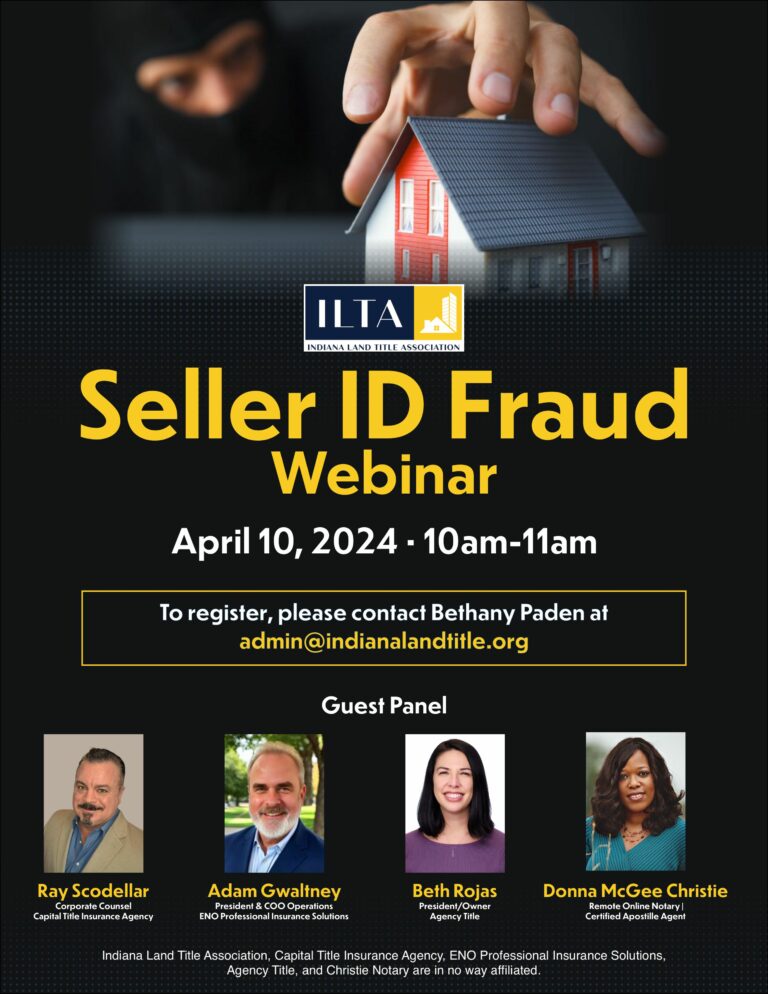

Register for the webinar here.

Despite the emergence of generative AI technologies, the fundamental best practices and security standards for lawyers have remained steadfast. While AI can automate certain tasks

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years.

Sign up for our newsletter to enjoy business tips, inspirations, and invites to free CLE webinars if you are a lawyer.