QBE-LawyerGuard – Tip of the Month – Lawyers’ Fraud Avoidance Duties Clarified

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Home » Professional Liability Insurance » Accountants Professional Liability

Get a Quote Contact Us Schedule a Meeting Email: info@eno.insure Call: (888) 365-4505

Share

What is Accountants Professional Liability Insurance?

Accountants Professional Liability Insurance is a type of insurance that provides coverage for accounting professionals against financial losses resulting from negligence or errors made in the course of providing professional services to clients.

Accountants, like other professionals, are expected to provide their clients with high-quality services, advice, and recommendations. However, even the most diligent and experienced accountants can make mistakes that can lead to significant financial losses for their clients. Accountants Professional Liability Insurance protects accounting professionals in the event that they are sued by a client for errors or omissions in their work.

The policy typically covers the cost of legal fees, settlements, and judgments that result from a claim made against the accountant. It can also cover the costs of hiring experts and investigators to help defend the claim.

What does Accountants Professional Liability Insurance cover?

Accountants Professional Liability Insurance covers a range of claims that may arise from the services provided by accounting professionals. These may include:

It is important to note that the specific coverage provided by an Accountants Professional Liability Insurance policy can vary depending on the insurer and the policy’s terms and conditions. Therefore, it is important for accounting professionals to carefully review and understand their policy to ensure they have adequate protection for their specific needs.

What doesn’t Accountants Professional Liability Insurance cover?

While Accountants Professional Liability Insurance provides coverage for many claims, there are some situations and types of losses that it typically does not cover. Here are some examples of what may not be covered under an Accountants Professional Liability Insurance policy:

It’s important to carefully review the terms and conditions of an Accountants Professional Liability Insurance policy to fully understand what is covered and what is excluded.

Our Carriers

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years. We take pride in our ability to provide our clients with personalized service and customizable insurance solutions that meet their specific needs. Our knowledgeable and experienced staff is dedicated to providing our clients with the best service possible.

Adam Gwaltney, President, COO

Who needs Accountants Professional Liability Insurance?

Accountants Professional Liability Insurance is essential for accounting professionals who provide services to clients, including:

Any accounting professional who provides professional services or advice to clients has the potential to make errors or omissions that can result in financial losses for clients. Therefore, Accountants Professional Liability Insurance is crucial to protect against potential legal claims and the financial consequences that may result from these claims.

In addition, many clients may require accounting professionals to have professional liability insurance as a condition of doing business. This can help to establish trust and confidence in the accounting professional’s ability to provide high-quality services and handle potential issues that may arise.

Overall, Accountants Professional Liability Insurance is an important form of protection for accounting professionals, and it is recommended that all accounting professionals consider obtaining this type of insurance.

What Policy Limits are right for my business?

Determining the right Accountants Professional Liability Insurance policy limits for your business can depend on various factors such as the size of your business, the types of clients you work with, and the level of risk associated with your work.

When considering policy limits, it is important to assess the potential risks and financial consequences of a lawsuit against your business. Generally, the policy limit refers to the maximum amount that the insurance company will pay for a covered claim.

Some factors to consider when determining your policy limits include:

It is recommended to consult with an insurance professional who specializes in Accountants Professional Liability Insurance to determine the appropriate policy limits for your business. An insurance professional can help you evaluate your risks and exposures and recommend a policy limit that aligns with your specific needs and budget.

How much does a Accountants Professional Liability Insurance policy cost?

The cost of Accountants Professional Liability Insurance can vary depending on several factors, such as the size of the accounting firm, the type of services provided, the policy limit, and the deductible. Other factors that can impact the cost of the insurance include the location of the business and the claims history of the firm.

In general, smaller accounting firms with lower policy limits and deductibles will pay lower premiums than larger firms with higher limits and deductibles. The cost of the insurance can also vary based on the insurer and the coverage options included in the policy.

As a rough estimate, the cost of Accountants Professional Liability Insurance can range from a few thousand dollars per year for smaller firms with lower policy limits and deductibles, to tens of thousands of dollars or more per year for larger firms with higher limits and deductibles.

It is important for accounting professionals to carefully evaluate their risks and exposures and work with an insurance professional to obtain appropriate coverage at a competitive price. The cost of the insurance should be weighed against the potential costs of a lawsuit and the financial protection provided by the insurance.

Where is the eno.insure team licensed to sell Accountants Professional Liability Insurance?

The eno.insure team is licensed in the following states:

Share

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

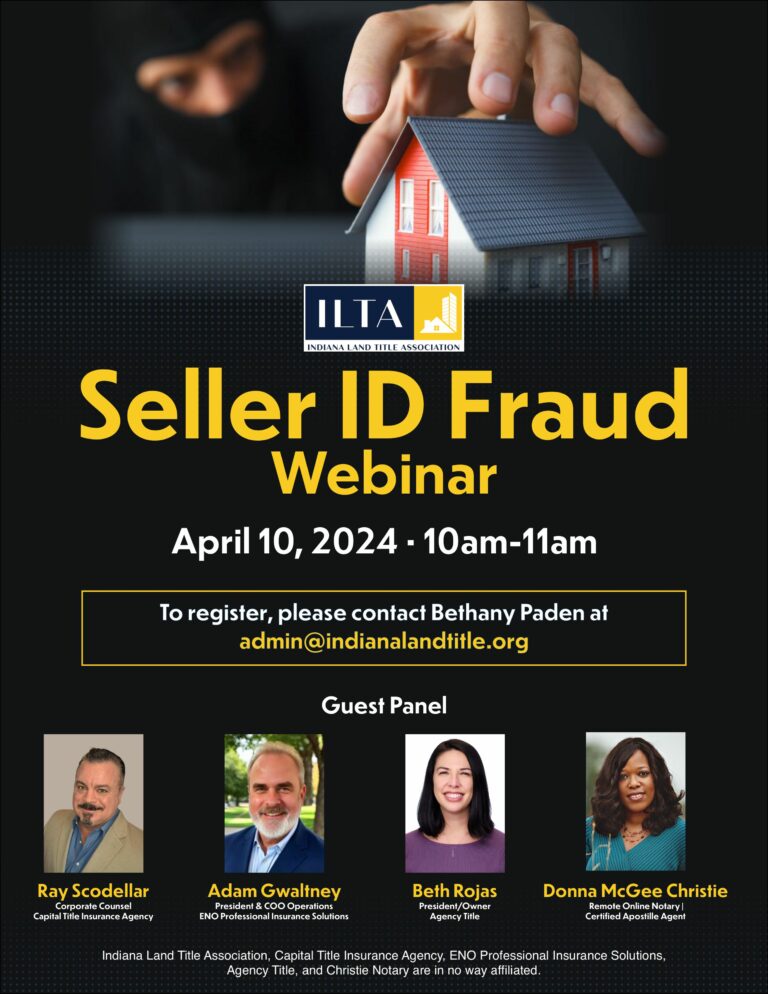

Register for the webinar here.

Despite the emergence of generative AI technologies, the fundamental best practices and security standards for lawyers have remained steadfast. While AI can automate certain tasks

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years.

Sign up for our newsletter to enjoy business tips, inspirations, and invites to free CLE webinars if you are a lawyer.