QBE-LawyerGuard – Tip of the Month – Lawyers’ Fraud Avoidance Duties Clarified

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Home » Commercial Insurance » Surety Bond

Get a Quote Contact Us Schedule a Meeting Email: info@eno.insure Call: (888) 365-4505

Share

What is a Surety Bond?

Surety bonds are a type of contract between three parties: the principal, the obligee, and the surety. The principal is the individual or organization that is required to provide the bond, the obligee is the entity that requires the bond, and the surety is the company that provides the bond.

A surety bond is a financial guarantee that the principal will fulfill certain obligations or responsibilities to the obligee. If the principal fails to meet their obligations, the surety will step in to compensate the obligee for any losses incurred.

There are several different types of surety bonds, including:

Surety bonds can provide valuable protection to obligees by ensuring that principals fulfill their obligations, but they can also be costly for principals, who typically pay a percentage of the bond amount as a premium to the surety. However, for many individuals and organizations, surety bonds are a necessary requirement to conduct business or fulfill legal obligations.

What does a Surety Bond cover?

Surety bonds provide a financial guarantee that the principal will fulfill their obligations to the obligee. The specific coverage of a surety bond will depend on the type of bond and the terms of the agreement between the principal, obligee, and surety.

Overall, the purpose of a surety bond is to provide financial protection to the obligee in the event that the principal fails to meet their obligations. By guaranteeing payment or performance, surety bonds can help ensure that businesses and individuals fulfill their obligations and can help protect against financial losses due to non-performance or non-payment.

What doesn’t a Surety Bond cover?

While surety bonds can provide valuable financial protection to obligees in the event that principals fail to meet their obligations, there are certain situations and types of losses that may not be covered by a surety bond. Here are some examples:

It’s important to carefully review the terms of a surety bond to understand what is and isn’t covered. In some cases, it may be necessary to purchase additional insurance or take other steps to protect against potential losses that may not be covered by the surety bond.

Our Carriers

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years. We take pride in our ability to provide our clients with personalized service and customizable insurance solutions that meet their specific needs. Our knowledgeable and experienced staff is dedicated to providing our clients with the best service possible.

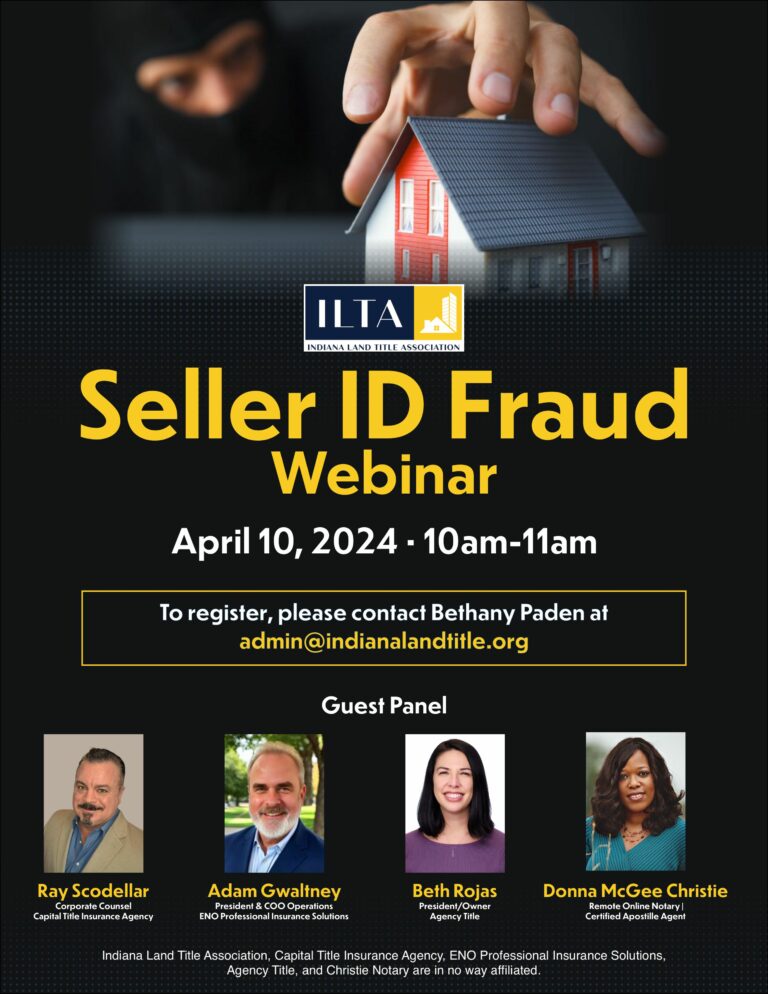

Adam Gwaltney, President, COO

Who needs Surety Bonds?

Surety bonds may be required for a variety of individuals and businesses depending on the nature of their work or legal obligations. Here are some examples of who may need a surety bond:

Overall, the specific requirements for obtaining a surety bond will depend on the nature of the work or legal obligation involved. It’s important to carefully review any requirements and work with a reputable surety bond provider to obtain the appropriate bond.

What size of Surety Bond is right for my business?

The appropriate size of a surety bond for your business will depend on a variety of factors, including the nature of your work, the size and complexity of your projects, and the requirements of your clients or licensing agencies. Here are some factors to consider when determining the appropriate size of your surety bond:

It’s important to work with a reputable surety bond provider who can help you determine the appropriate bond size for your business. A surety bond provider can also help you understand the specific requirements and regulations related to surety bonds in your industry or location.

How much does a Surety Bond cost?

The cost of a surety bond will depend on a variety of factors, including the size of the bond, the type of work or project involved, and the risk associated with the bond. Here are some of the factors that can impact the cost of a surety bond:

It’s important to work with a reputable surety bond provider to obtain an accurate quote for your specific bond needs. The cost of a surety bond is typically a percentage of the bond amount, ranging from 1-15% depending on the above factors.

To get a better idea of the cost of a surety bond for a specific business or profession, it’s best to consult with us so that we can provide a customized quote based on the individual needs and risk factors.

Where is the eno.insure team licensed to sell Surety Bonds?

The eno.insure team is licensed in the following states:

Share

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Register for the webinar here.

Despite the emergence of generative AI technologies, the fundamental best practices and security standards for lawyers have remained steadfast. While AI can automate certain tasks

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years.

Sign up for our newsletter to enjoy business tips, inspirations, and invites to free CLE webinars if you are a lawyer.