QBE-LawyerGuard – Tip of the Month – Lawyers’ Fraud Avoidance Duties Clarified

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Home » Professional Liability Insurance » Architect and Engineer Professional Liability

Get a Quote Contact Us Schedule a Meeting Email: info@eno.insure Call: (888) 365-4505

Share

What is Architect and Engineer Professional Liability Insurance?

Architects & Engineers Professional Liability Insurance, also known as Professional Liability Insurance for architects and engineers, is a specialized form of insurance that provides coverage for legal claims arising from errors or omissions in the professional services provided by architects and engineers.

Architects and engineers are responsible for designing and implementing complex building and infrastructure projects, such as bridges, roads, buildings, and other structures. In the course of their work, they may make mistakes or encounter unforeseen circumstances that can lead to costly legal claims from clients, contractors, or other parties.

Architects & Engineers Professional Liability Insurance is designed to protect these professionals against the financial consequences of such claims, including defense costs, settlements, and judgments. The insurance policy typically covers claims related to design errors, construction defects, professional negligence, and other types of errors or omissions related to the professional services provided by architects and engineers.

Architects & Engineers Professional Liability Insurance is an essential form of protection for architects and engineers, and it is often required by clients and contractors as a condition of doing business. It can help to establish trust and confidence in the architect or engineer’s ability to provide high-quality services and handle potential issues that may arise.

What does Architect and Engineer Professional Liability Insurance cover?

Architects & Engineers Professional Liability Insurance provides coverage for legal claims arising from errors or omissions in the professional services provided by architects and engineers. The specific coverage provided by the insurance policy can vary depending on the insurer and the terms of the policy. However, some common types of coverage provided by Architects & Engineers Professional Liability Insurance include:

It is important to carefully review the terms and conditions of the insurance policy to understand the specific coverage provided and any exclusions or limitations. An insurance professional specializing in Architects & Engineers Professional Liability Insurance can help architects and engineers select the appropriate coverage for their specific needs and risks.

What doesn’t Architect and Engineer Professional Liability Insurance cover?

While Architects & Engineers Professional Liability Insurance is designed to provide coverage for legal claims arising from errors or omissions in the professional services provided by architects and engineers, there are some situations that may not be covered by the insurance policy. Some common exclusions or limitations of Architects & Engineers Professional Liability Insurance can include:

It is important to carefully review the terms and conditions of the insurance policy to understand the specific coverage provided and any exclusions or limitations. An insurance professional specializing in Architects & Engineers Professional Liability Insurance can help architects and engineers select the appropriate coverage for their specific needs and risks.

Our Carriers

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years. We take pride in our ability to provide our clients with personalized service and customizable insurance solutions that meet their specific needs. Our knowledgeable and experienced staff is dedicated to providing our clients with the best service possible.

Adam Gwaltney, President, COO

Who needs Architect and Engineer Professional Liability Insurance?

Architects and engineers who provide professional services in the design and construction industry should consider purchasing Architects & Engineers Professional Liability Insurance. This type of insurance is essential for architects and engineers who are responsible for designing and implementing complex building and infrastructure projects, such as bridges, roads, buildings, and other structures.

Architects & Engineers Professional Liability Insurance is also important for individuals or firms that provide specialized services, such as environmental or geotechnical consulting, as well as those who provide services in the areas of energy, transportation, or public works.

Clients and contractors may require architects and engineers to have Professional Liability Insurance as a condition of doing business. Additionally, architects and engineers may be required to have this type of insurance to comply with state or local regulations or professional licensing requirements.

Even with the best intentions and professional care, architects and engineers can make mistakes or encounter unforeseen circumstances that can lead to costly legal claims. Architects & Engineers Professional Liability Insurance provides protection against these risks and can help to establish trust and confidence in the architect or engineer’s ability to provide high-quality services and handle potential issues that may arise.

What Policy Limits are right for my business?

The appropriate policy limits for Architects & Engineers Professional Liability Insurance will depend on the specific needs and risks of your business. The policy limits determine the maximum amount that the insurance company will pay for a covered claim.

When selecting policy limits for Architects & Engineers Professional Liability Insurance, consider factors such as the size and complexity of the projects you work on, the types of services you provide, and the potential financial impact of a claim. Higher policy limits generally provide greater protection but may also come with higher premiums.

Some common policy limits for Architects & Engineers Professional Liability Insurance include:

Policy limits can vary widely depending on the insurer and the specific terms of the policy. An insurance professional specializing in Architects & Engineers Professional Liability Insurance can help you evaluate your business’s specific risks and determine the appropriate policy limits for your needs. It is important to carefully review the terms and conditions of the insurance policy to understand the specific coverage provided and any exclusions or limitations.

How much does a Architect and Engineer Professional Liability Insurance policy cost?

The cost of Architects & Engineers Professional Liability Insurance can vary depending on a variety of factors, including the size and type of business, the level of risk associated with the services provided, the policy limits, and the deductible. In general, the cost of the insurance is typically based on the revenue generated by the business or the number of professionals covered by the policy.

According to some industry estimates, the cost of Architects & Engineers Professional Liability Insurance can range from $2,500 to $20,000 or more per year, depending on the specific circumstances of the business. The cost of the insurance may be higher for larger firms, those with a history of claims, or those working on high-risk projects, such as those in the healthcare or energy sectors.

While the cost of the insurance may seem high, it is important to consider the potential financial impact of a legal claim. Even a single claim can result in significant legal fees, settlement costs, and damage to the reputation of the business. Architects & Engineers Professional Liability Insurance provides important protection against these risks and can help to safeguard the financial stability of the business.

To get an accurate estimate of the cost of Architects & Engineers Professional Liability Insurance for your business, it is important to work with an insurance professional who specializes in this type of coverage. They can help you evaluate the specific risks associated with your business and provide guidance on the appropriate coverage and policy limits for your needs.

Where is the eno.insure team licensed to sell Architect and Engineer Professional Liability Insurance?

The eno.insure team is licensed in the following states:

Share

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

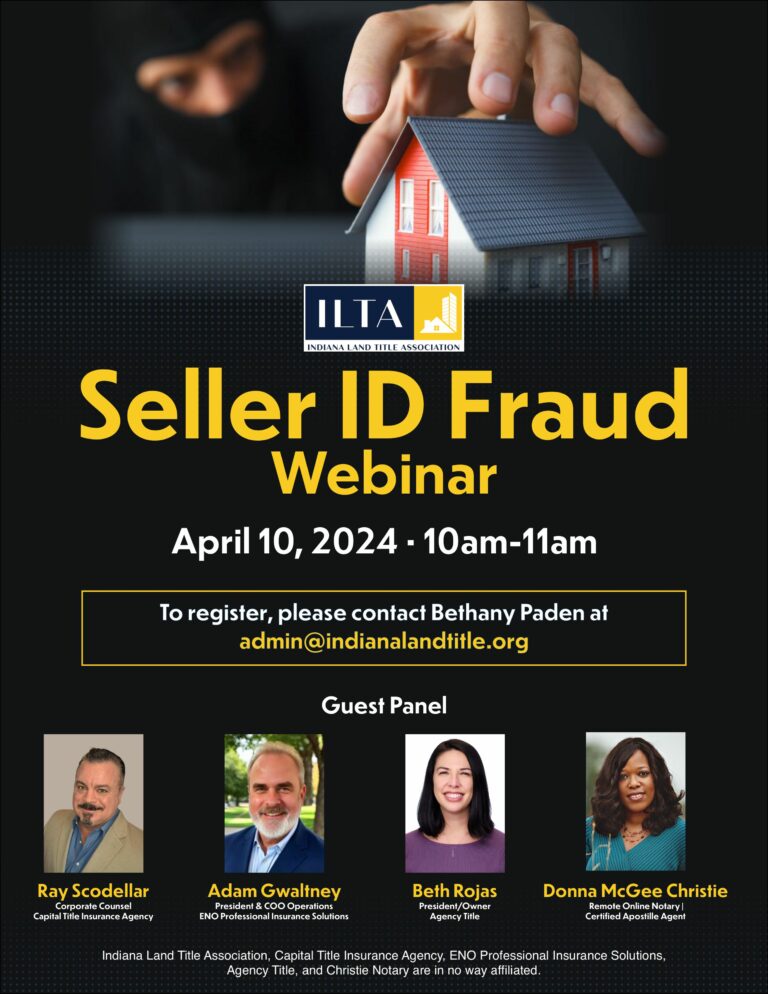

Register for the webinar here.

Despite the emergence of generative AI technologies, the fundamental best practices and security standards for lawyers have remained steadfast. While AI can automate certain tasks

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years.

Sign up for our newsletter to enjoy business tips, inspirations, and invites to free CLE webinars if you are a lawyer.