QBE-LawyerGuard – Tip of the Month – Lawyers’ Fraud Avoidance Duties Clarified

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Home » Professional Liability Insurance » Technology Errors & Omissions Insurance

Get a Quote Contact Us Schedule a Meeting Email: info@eno.insure Call: (888) 365-4505

Share

What is Technology Errors & Omissions Insurance?

Technology Errors & Omissions (E&O) Insurance, also known as Professional Liability Insurance for technology professionals, is a type of insurance coverage designed to protect businesses and individuals who provide technology-related products or services from claims of negligence or errors in their work. This type of insurance is particularly important for technology companies, including software developers, IT consultants, and other technology service providers, who are exposed to significant risks related to the performance of their products and services.

Technology E&O Insurance provides coverage for a range of potential claims, including allegations of software or hardware failure, data breaches or loss, system downtime or interruption, and other technology-related errors or omissions that result in financial losses for clients or other third parties. This type of insurance typically covers the costs associated with defending against these claims, as well as any damages that may be awarded to clients or other third parties in the event of a successful claim.

In addition to providing protection against claims related to errors and omissions in technology products or services, Technology E&O Insurance may also cover claims related to intellectual property infringement, privacy violations, and other legal issues related to the technology industry. This coverage is essential for businesses and individuals who rely on technology to provide products and services to their clients, and who are exposed to significant risks related to the performance of their technology products and services.

What does Technology Errors & Omissions Insurance cover?

Technology Errors & Omissions (E&O) Insurance typically covers claims related to errors, omissions, or negligence in the provision of technology products or services. This can include claims related to software or hardware failure, system downtime or interruption, data breaches or loss, and other errors or omissions that result in financial losses for clients or other third parties.

In addition to covering claims related to errors and omissions in technology products or services, Technology E&O Insurance may also cover claims related to intellectual property infringement, privacy violations, and other legal issues related to the technology industry. For example, if a company is sued for patent infringement or accused of stealing intellectual property, Technology E&O Insurance may provide coverage for the costs of defending against these claims, as well as any damages that may be awarded to the plaintiff in the event of a successful claim.

Overall, Technology E&O Insurance provides important protection for businesses and individuals who provide technology-related products or services, and helps to safeguard their financial stability and reputation in the event of a claim. However, it’s important to note that the specific coverage provided by a Technology E&O Insurance policy can vary depending on the insurer and the policy terms and conditions, so it’s important to review your policy carefully to understand the scope of your coverage.

What doesn’t Technology Errors & Omissions Insurance cover?

Technology Errors & Omissions (E&O) Insurance typically does not cover claims related to intentional or fraudulent acts, criminal activity, or other types of misconduct. For example, if a technology professional deliberately steals client data or engages in other illegal behavior, their Technology E&O Insurance policy may not cover any resulting claims or damages.

In addition, Technology E&O Insurance may not cover claims related to bodily injury or property damage caused by technology products or services. This type of coverage is typically provided by Commercial General Liability (CGL) Insurance or other types of liability insurance policies.

It’s also important to note that the specific coverage provided by a Technology E&O Insurance policy can vary depending on the insurer and the policy terms and conditions. Some policies may have specific exclusions or limitations on coverage, so it’s important to carefully review your policy to understand the scope of your coverage and any potential exclusions.

Our Carriers

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years. We take pride in our ability to provide our clients with personalized service and customizable insurance solutions that meet their specific needs. Our knowledgeable and experienced staff is dedicated to providing our clients with the best service possible.

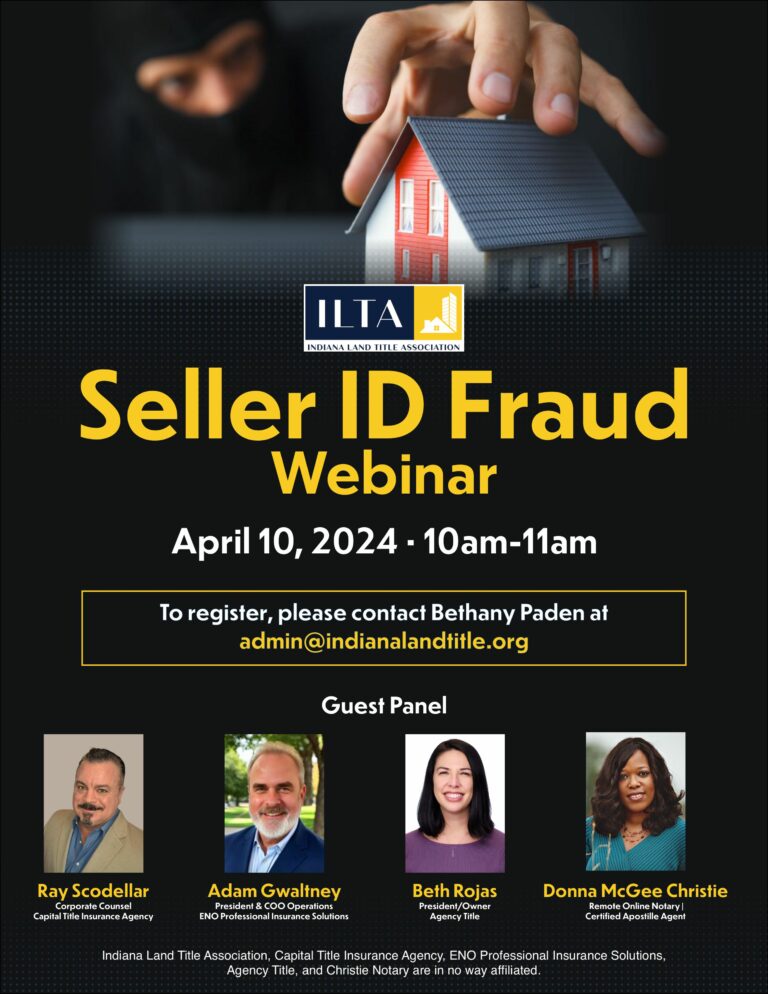

Adam Gwaltney, President, COO

Who needs Technology Errors & Omissions Insurance?

Technology Errors & Omissions (E&O) Insurance is designed for businesses and individuals who provide technology-related products or services. This can include software developers, IT consultants, website designers, digital marketers, and other professionals who work in the technology industry.

Any business or individual who provides technology-related products or services is exposed to potential risks and liabilities, including the risk of errors, omissions, or negligence in the provision of those products or services. Technology E&O Insurance provides important protection for these businesses and individuals by helping to cover the costs of defending against claims and lawsuits related to these risks, as well as any damages that may be awarded to the plaintiff in the event of a successful claim.

In addition, many clients or customers of technology professionals may require that they carry Technology E&O Insurance as a condition of doing business with them. This is particularly common in industries where the risk of financial losses from technology-related errors or omissions is high, such as healthcare, finance, and government.

Overall, Technology E&O Insurance is an important type of insurance for businesses and individuals who work in the technology industry, and can help to protect their financial stability and reputation in the event of a claim.

What Policy Limits are right for my business?

The appropriate Technology Errors & Omissions (E&O) Insurance policy limits for your business will depend on a number of factors, including the size and nature of your business, the types of technology products or services you provide, and your level of exposure to potential claims and lawsuits.

Generally, the higher your risk of exposure to potential claims, the higher the policy limits you will need. Some factors that may increase your risk of claims include the complexity of the technology products or services you provide, the size of the contracts you work on, and the level of customization or integration involved in your work.

In addition, you may want to consider any contractual requirements or industry standards that may apply to your business. Many clients or customers may require that you carry a certain level of Technology E&O Insurance as a condition of doing business with them, and industry standards may also provide guidance on appropriate policy limits.

It’s important to work with an experienced insurance agent or broker who can help you assess your risks and determine appropriate policy limits for your business. They can also help you understand any specific requirements or restrictions that may apply to your policy, such as deductibles or exclusions. By working closely with your agent or broker, you can ensure that you have the appropriate level of coverage to protect your business in the event of a claim.

How much does a Technology Errors & Omissions Insurance policy cost?

The cost of a Technology Errors & Omissions (E&O) Insurance policy can vary widely depending on a number of factors, including the size and nature of your business, the types of technology products or services you provide, and your level of exposure to potential claims and lawsuits.

Other factors that can affect the cost of your policy include your chosen policy limits and deductible, any previous claims or litigation history, and the level of coverage provided by the policy.

To get an accurate estimate of the cost of a Technology E&O Insurance policy for your business, you should contact a licensed insurance agent or broker who specializes in this type of insurance. They can provide you with a customized quote based on your specific business needs and risk factors.

As a general guideline, however, the cost of a Technology E&O Insurance policy can range from a few thousand dollars per year for small businesses with minimal exposure to claims, up to tens of thousands of dollars or more per year for larger businesses with more complex operations and higher levels of risk exposure.

Keep in mind that the cost of insurance is just one factor to consider when selecting a policy. It’s also important to consider the level of coverage provided by the policy, as well as any limitations or exclusions that may apply, to ensure that you have the appropriate level of protection for your business.

Where is the eno.insure team licensed to sell Technology Errors & Omissions Insurance?

The eno.insure team is licensed in the following states:

Share

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Register for the webinar here.

Despite the emergence of generative AI technologies, the fundamental best practices and security standards for lawyers have remained steadfast. While AI can automate certain tasks

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years.

Sign up for our newsletter to enjoy business tips, inspirations, and invites to free CLE webinars if you are a lawyer.