QBE-LawyerGuard – Tip of the Month – Lawyers’ Fraud Avoidance Duties Clarified

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Please note! At this time, eno.insure is unable to write any business property insurance in the state of Florida. This will include, but may not be limited to, Business Owners Policies, Business Personal Property, General Liability, Commercial Auto, Commercial Umbrella.

Home » Commercial Insurance » Commercial Auto Insurance

Get a Quote Contact Us Schedule a Meeting Email: info@eno.insure Call: (888) 365-4505

Share

What is Commercial Auto Insurance?

Commercial auto insurance is a type of insurance policy that provides coverage for businesses that use vehicles for commercial purposes. It covers physical damage and liability for accidents involving commercial vehicles, such as trucks, vans, and cars, used for business purposes.

Commercial auto insurance covers a range of risks that businesses face, including collision damage, theft, vandalism, and liability claims for bodily injury and property damage caused by a commercial vehicle. It is essential for businesses that use vehicles to transport goods, equipment, or people to have commercial auto insurance in place.

The coverage provided by commercial auto insurance varies depending on the policy and the specific needs of the business. It can include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage.

The cost of commercial auto insurance depends on several factors, such as the number of vehicles insured, the type of vehicles, the driving history of the drivers, and the coverage limits selected. Working with an experienced insurance provider can help businesses identify the right coverage options and policy limits to protect their assets and ensure that they comply with state and federal regulations.

What does Commercial Auto Insurance cover?

Commercial auto insurance covers a range of risks associated with using vehicles for business purposes. Some of the common coverages included in commercial auto insurance policies are:

Commercial auto insurance can also cover other aspects of business vehicle use, such as hired and non-owned vehicle coverage, which provides liability coverage for vehicles that your business uses but does not own.

It is important to note that commercial auto insurance policies can vary depending on the specific needs of a business. Working with an experienced insurance provider can help businesses identify the right coverage options and policy limits to protect their assets and ensure that they comply with state and federal regulations.

What doesn’t Commercial Auto Insurance cover?

While commercial auto insurance provides coverage for a range of risks associated with using vehicles for business purposes, there are some situations and circumstances that it may not cover. Some examples of things that commercial auto insurance typically does not cover include:

It is important to review the specific policy and coverage options with an experienced insurance provider to understand the limitations of commercial auto insurance and determine if additional coverage is necessary to fully protect a business.

Our Carriers

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years. We take pride in our ability to provide our clients with personalized service and customizable insurance solutions that meet their specific needs. Our knowledgeable and experienced staff is dedicated to providing our clients with the best service possible.

Adam Gwaltney, President, COO

Who needs Commercial Auto Insurance?

Any business that uses vehicles for commercial purposes, such as transporting goods, making deliveries, or providing transportation for employees or clients, should consider purchasing commercial auto insurance. Some examples of businesses that may need commercial auto insurance include:

It is important to consult with an experienced insurance provider to determine the specific coverage needs of a business and ensure that the policy meets state and federal regulations.

What Policy Limits are right for my business?

The appropriate commercial auto insurance policy limits for a business depend on several factors, such as the number of vehicles owned or leased by the business, the type of business, the risks associated with the vehicles, and the state and federal laws governing commercial auto insurance.

The most common commercial auto insurance policy limits include:

It is important to work with an experienced insurance provider to determine the appropriate commercial auto insurance policy limits for a business based on its specific needs and risks.

How much does a Commercial Auto Insurance policy cost?

The cost of commercial auto insurance varies depending on several factors, including the type of business, the number of vehicles insured, the type and value of the vehicles, the coverage limits, the driving records of the drivers, and the location of the business.

On average, commercial auto insurance costs range from $1,200 to $2,400 per year per vehicle, but this can vary widely depending on the factors mentioned above.

To get a better idea of the cost of commercial auto insurance for a specific business or profession, it’s best to consult with us so that we can provide a customized quote based on the individual needs and risk factors.

Where is the eno.insure team licensed to sell Commercial Auto Insurance?

The eno.insure team is licensed in the following states:

Share

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

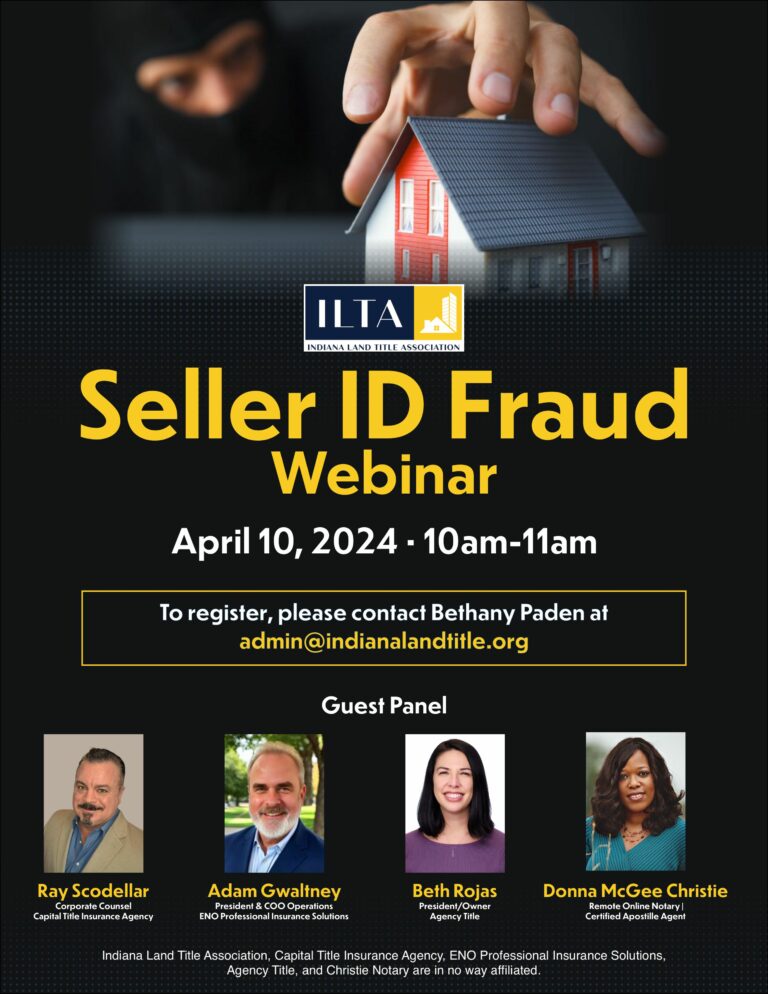

Register for the webinar here.

Despite the emergence of generative AI technologies, the fundamental best practices and security standards for lawyers have remained steadfast. While AI can automate certain tasks

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years.

Sign up for our newsletter to enjoy business tips, inspirations, and invites to free CLE webinars if you are a lawyer.