QBE-LawyerGuard – Tip of the Month – Lawyers’ Fraud Avoidance Duties Clarified

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Home » Commercial Insurance » Workers’ Compensation

Get a Quote Contact Us Schedule a Meeting Email: info@eno.insure Call: (888) 365-4505

Share

What is Workers’ Compensation Insurance?

Workers’ Compensation Insurance is a type of insurance that provides benefits to employees who are injured or become ill as a result of their job. The insurance covers medical expenses, lost wages, and other related costs associated with a work-related injury or illness. In exchange for these benefits, employees are typically required to give up their right to sue their employer for negligence or other related claims.

What does Workers’ Compensation Insurance cover?

Workers’ Compensation Insurance covers medical expenses, lost wages, and rehabilitation costs for employees who are injured or become ill as a result of their job. It can also cover legal fees associated with any claims made by employees. In general, workers’ compensation insurance provides benefits to employees regardless of who was at fault for the accident or illness.

What doesn’t Workers’ Compensation Insurance cover?

Workers’ compensation insurance typically does not cover injuries or illnesses that are not work-related. For example, if an employee becomes sick or injured while engaging in an activity outside of work, they would not be covered by workers’ compensation insurance. Additionally, workers’ compensation insurance may not cover injuries or illnesses that result from an employee’s willful misconduct or drug or alcohol use. Finally, workers’ compensation insurance may not cover certain types of workers, such as independent contractors or volunteers.

Our Carriers

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years. We take pride in our ability to provide our clients with personalized service and customizable insurance solutions that meet their specific needs. Our knowledgeable and experienced staff is dedicated to providing our clients with the best service possible.

Adam Gwaltney, President, COO

Who needs Workers’ Compensation Insurance?

In general, any business that has employees is required by law to have workers’ compensation insurance. This includes both full-time and part-time employees, as well as contractors in some cases. The specific requirements for workers’ compensation insurance vary by state, so it’s important to check the regulations in your state to determine whether your business needs this type of coverage. Some states may also require workers’ compensation coverage for business owners and officers who are not technically employees but perform services for the company.

What Policy Limits are right for my business?

The policy limits for workers’ compensation insurance can vary depending on the state in which your business operates. Each state has its own minimum coverage requirements for employers. It is important to comply with these requirements, but you may also choose to purchase higher limits for additional protection. Your insurance provider can help you determine the appropriate policy limits for your business based on factors such as the size of your workforce, the type of work they perform, and your business’s financial risk tolerance.

How much does a Workers’ Compensation Insurance policy cost?

The cost of Workers’ Compensation Insurance varies based on several factors, including the size of the business, the industry, the number of employees, the state in which the business is located, and the level of coverage needed. Typically, the cost of Workers’ Compensation Insurance is based on a percentage of an employee’s wages. The exact percentage varies by state and by the type of work being performed. In general, the higher the risk of injury or illness, the higher the cost of coverage. Employers can obtain Workers’ Compensation Insurance through private insurance carriers or through state-run insurance programs, with prices varying between providers. Employers can also work with an insurance broker to compare prices and find the best coverage for their business at a competitive price.

Where is the eno.insure team licensed to sell Workers’ Compensation Insurance?

The eno.insure team is licensed in the following states:

Share

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

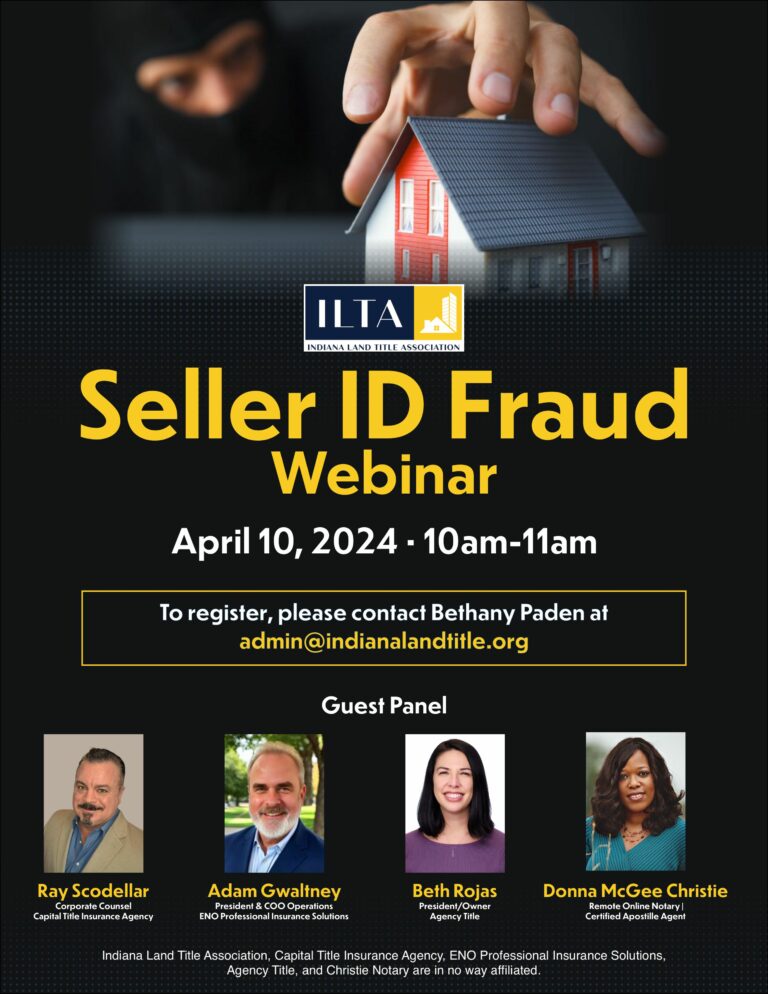

Register for the webinar here.

Despite the emergence of generative AI technologies, the fundamental best practices and security standards for lawyers have remained steadfast. While AI can automate certain tasks

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years.

Sign up for our newsletter to enjoy business tips, inspirations, and invites to free CLE webinars if you are a lawyer.