QBE-LawyerGuard – Tip of the Month – Lawyers’ Fraud Avoidance Duties Clarified

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

Please note! At this time, eno.insure is unable to write any business property insurance in the state of Florida. This will include, but may not be limited to, Business Owners Policies, Business Personal Property, General Liability, Commercial Auto, Commercial Umbrella.

Home » Commercial Insurance » Commercial Property Insurance

Get a Quote Contact Us Schedule a Meeting Email: info@eno.insure Call: (888) 365-4505

Share

What is Commercial Property Insurance?

Commercial property insurance is a type of insurance policy that provides coverage for physical assets owned by a business, including buildings, equipment, inventory, furniture, and fixtures. This coverage is designed to protect businesses from financial losses in the event of damage or destruction to their property caused by a covered peril, such as fire, theft, vandalism, or natural disasters.

Commercial property insurance typically provides coverage for the following:

The specific coverage and policy limits provided by commercial property insurance can vary depending on the policy and the needs of the business.

What does Commercial Property Insurance cover?

Commercial property insurance provides coverage for physical assets owned by a business, including buildings, equipment, inventory, furniture, and fixtures. The coverage provided by commercial property insurance can vary depending on the policy and the needs of the business.

What doesn’t Commercial Property Insurance cover?

Commercial property insurance typically does not cover the following:

It is important for businesses to carefully review their policy and understand the coverage and exclusions provided by their commercial property insurance policy.

Our Carriers

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years. We take pride in our ability to provide our clients with personalized service and customizable insurance solutions that meet their specific needs. Our knowledgeable and experienced staff is dedicated to providing our clients with the best service possible.

Adam Gwaltney, President, COO

Who needs Commercial Property Insurance?

Commercial property insurance is typically recommended for businesses that own or lease commercial property, such as buildings, warehouses, and equipment. This type of insurance is essential for businesses that rely on their property to operate, such as manufacturing facilities, retailers, and restaurants. It is also recommended for businesses that store valuable inventory or equipment on their premises.

In addition, commercial property insurance is often required by lenders or landlords as a condition of a lease or loan. Some industries may have specific legal requirements for commercial property insurance, such as construction companies that need to protect their equipment and materials on job sites. Business owners should consult with their insurance agent to determine if commercial property insurance is appropriate for their business.

What Policy Limits are right for my business?

Determining the appropriate commercial property insurance policy limits for your business depends on several factors, including the value of your property, the type of business you operate, and the potential risks that your business may face.

To determine the appropriate policy limits, consider the following:

It’s important to review your commercial property insurance policy regularly to ensure that your policy limits are still appropriate for your business’s needs. Contacting an insurance agent or broker can help you determine the appropriate policy limits for your business.

How much does a Commercial Property Insurance policy cost?

The cost of commercial property insurance can vary depending on several factors, including the location, size, and age of your property, the type of business you operate, and the amount of coverage you need.

Typically, the cost of commercial property insurance is calculated based on the value of your property, the level of risk associated with your business, and the deductible and policy limits you choose. In general, businesses with higher risk profiles, such as those in high-crime areas or with hazardous operations, can expect to pay higher premiums for commercial property insurance.

To get an accurate estimate of the cost of commercial property insurance for your business, it’s best to contact an insurance agent or broker who can provide you with a customized quote based on your business’s specific needs and risks.

The eno.insure team is licensed in the following states:

Where is the eno.insure team licensed to sell Commercial Property Insurance?

The eno.insure team is licensed in the following states:

Share

According to a report by the American Bar Association (ABA) in 2017, cyber attacks targeting law firms have been on the rise, and the cost

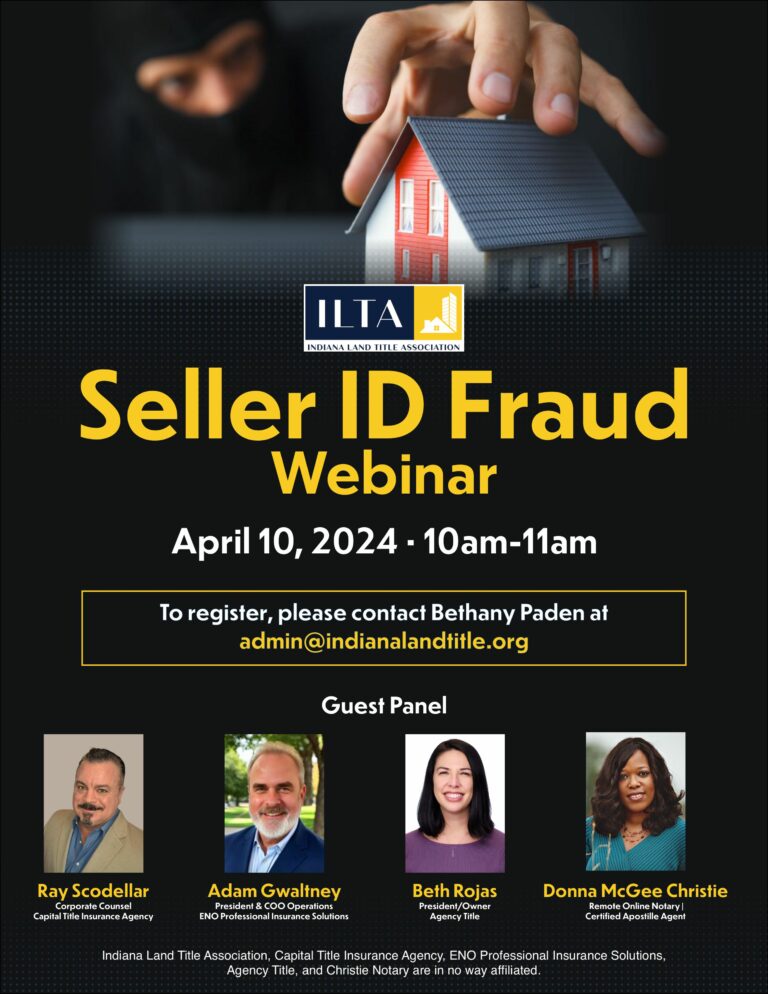

Register for the webinar here.

Despite the emergence of generative AI technologies, the fundamental best practices and security standards for lawyers have remained steadfast. While AI can automate certain tasks

ENO Insurance Agency is a family-owned and operated business that has been providing professional liability insurance to clients for over 20 years.

Sign up for our newsletter to enjoy business tips, inspirations, and invites to free CLE webinars if you are a lawyer.